We have already discussed the relevance of historical retail sale comps when appraising a used car but their importance when establishing your retail price for the lot should not be overlooked either. You will often hear people in the trade tell you that they simply follow the prices in their local market. That works if everyone else in your market can be trusted to price their inventory correctly; if not, you're allowing an unskilled individual to negatively impact your ability to make money.

So while you absolutely should assess your local retail market when pricing your used inventory, you must also compare that information to other data to make sure that it isn't steering you in the wrong direction.

Let's take a look at an example to better understand.

Case Study

Our example vehicle is a 2018 Hyundai Santa Fe with 23,976 miles that is listed for $18,297 and has been on the lot for 17 days.

When looking at the Appraisal Summary that shows an expected sale price of $18,880 we can see that there might be potential to ask a little more for this vehicle. It has a clean Carfax too which will make it more appealing to buyers.

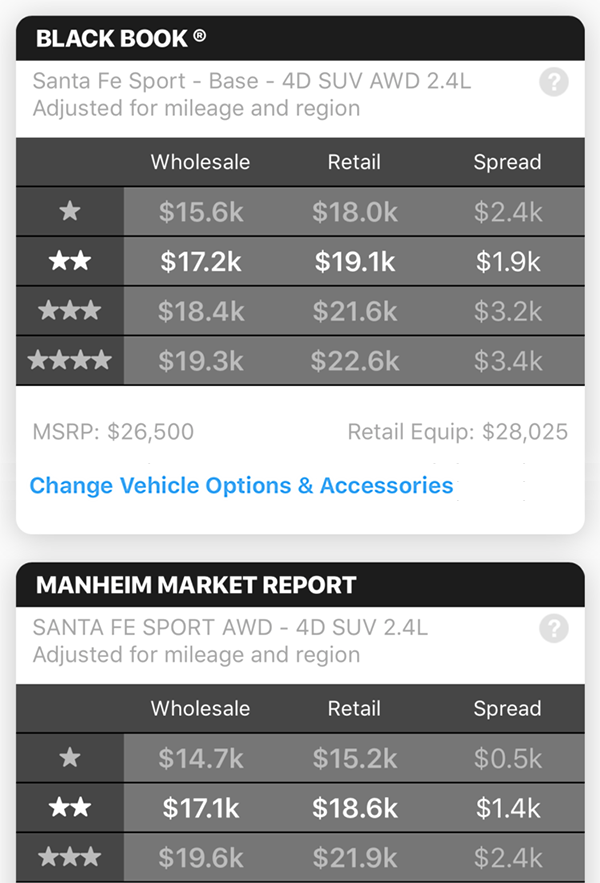

For average condition retail, Black Book shows $19,100 and Manheim Market Report shows $18,600 which is in line with what the Appraisal Summary number of $18,880 shows above.

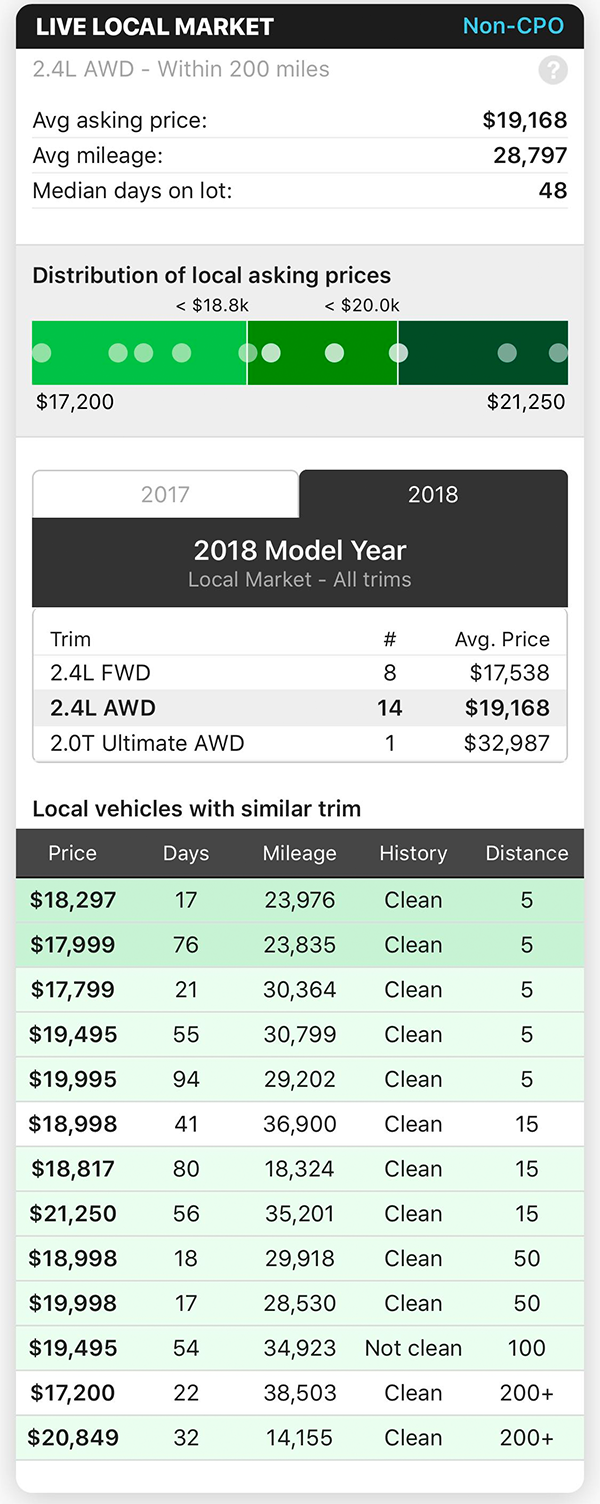

When consulting the Live Local Market report we see that the average retail asking price within 200 miles is $19,168, based on an average mileage of 28,797 which is slightly higher than the example we are assessing that has just shy of 24,000 miles.

There are only 14 of the 2.4l AWD models available and their price distribution is reasonably spread across the range between $17,200 and $21,250.

Having less local competition is always desirable but it does mean that it’s easier to fall into the trap of incorrectly pricing your inventory by following your competitors, as an outlier can easily skew the average numbers.

Despite this, these numbers still indicate that $18,297 is low considering that the vehicle has fewer miles than the average.

Once we get down to the detailed list of competitor vehicles in the Live Local Market, you can see that this dealer does have some extremely aggressively priced local competitors within 5 miles.

One of them has been on the lot for 76 days though which far exceeds the average of 48 days shown earlier in the report.

The second aggressively priced unit has more miles and while arguably still underpriced, isn’t something that this dealer should be trying to compete with.

Our dealer has only been on the market for 17 days which is still a long way below the average of 48 days and there’s no reason that he shouldn’t aim for a higher asking price like some of the other competitors who are a little further away.

When you find yourself in a position like this with immediate local competitors well below book values, it’s easy to second guess yourself when it comes to pricing. We all want to make as much as we can but not at the cost of market opportunity and turn. There’s nothing worse than putting your cash into something only to watch it age and depreciate on the lot.

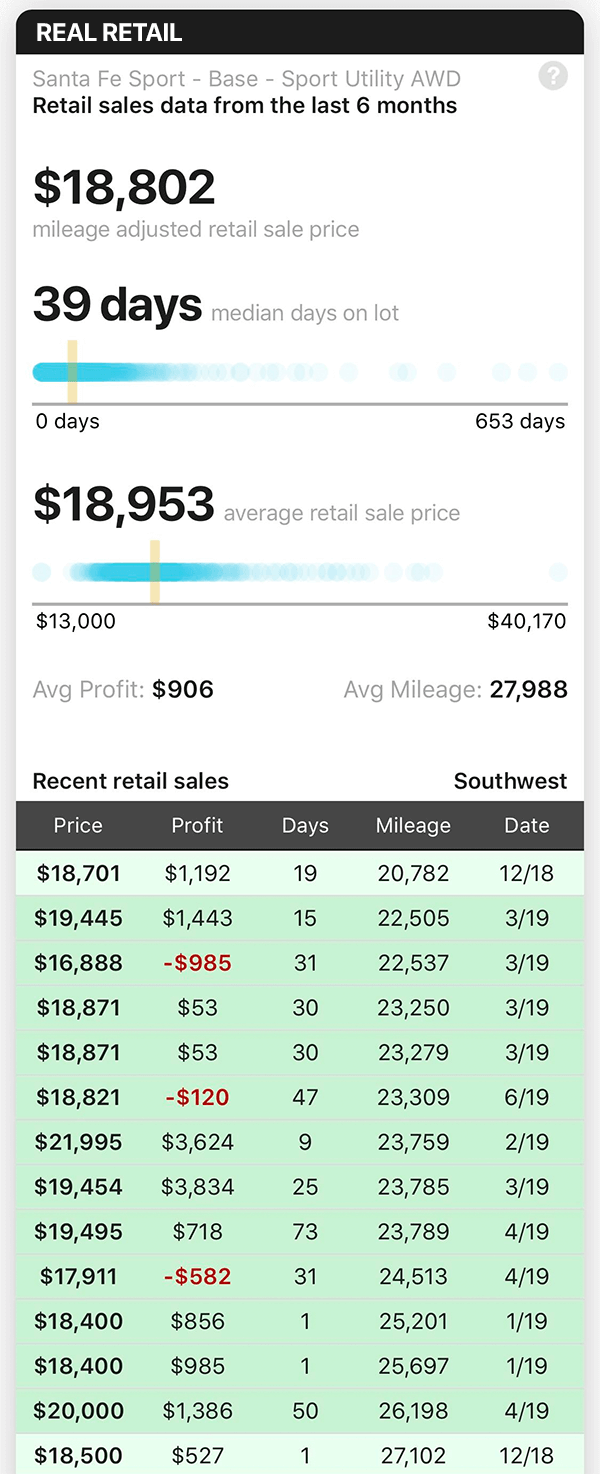

In situations like this historical retail transactions are extremely useful. Seeing the final sale prices and profits from recent transactions in your region will show you if your immediate local competitors are correct because the market has dropped dramatically or, are in fact below market and should not be followed when setting price.

In this instance, the recent transactions show that this dealer should not follow his immediate local competitors when pricing. The average price of recent sales is $18,953 with a mileage adjusted suggested retail sale price of $18,802.

Looking at the individual transactions is more encouraging still with other dealers closing in the 19s for cars with similar miles.

At $18,297 asking, this dealer will still have to negotiate a sale and can at best hope to close in the high 17s while other dealers are averaging almost $1000 more.

Had our dealer in question used historical comps, they would have known not to let their immediate local competitors’ extremely low prices influence their pricing strategy and had the confidence to list for more, basing the decision on real transaction data.

We are all in the business to make money and while mistakes like this might seem small, just image the impact to your bottom line if you could increase your gross on every transaction in a year.